Delta-Neutral Digital Asset Growth

Growing your capital with minimized risk has never been easier thanks to Everbloom’s Automated Digital Asset Strategies.

Hybrid Approach

Everbloom strategies generate yield by bridging the gap between decentralized finance opportunities and centralised exchanges by coordinating liquidity allocation across these two ecosystems.

Decentralized Finance offers us attractive yields for liquidity provisioning, but it also exposes us to impermanent loss and marketvolatility.

Centralized platforms offer institutional-grade security and deep liquidity, which we utilize to hedge against the market volatility we encounter in DeFi.

Delta-Neutral Yield Farming

Everbloom features

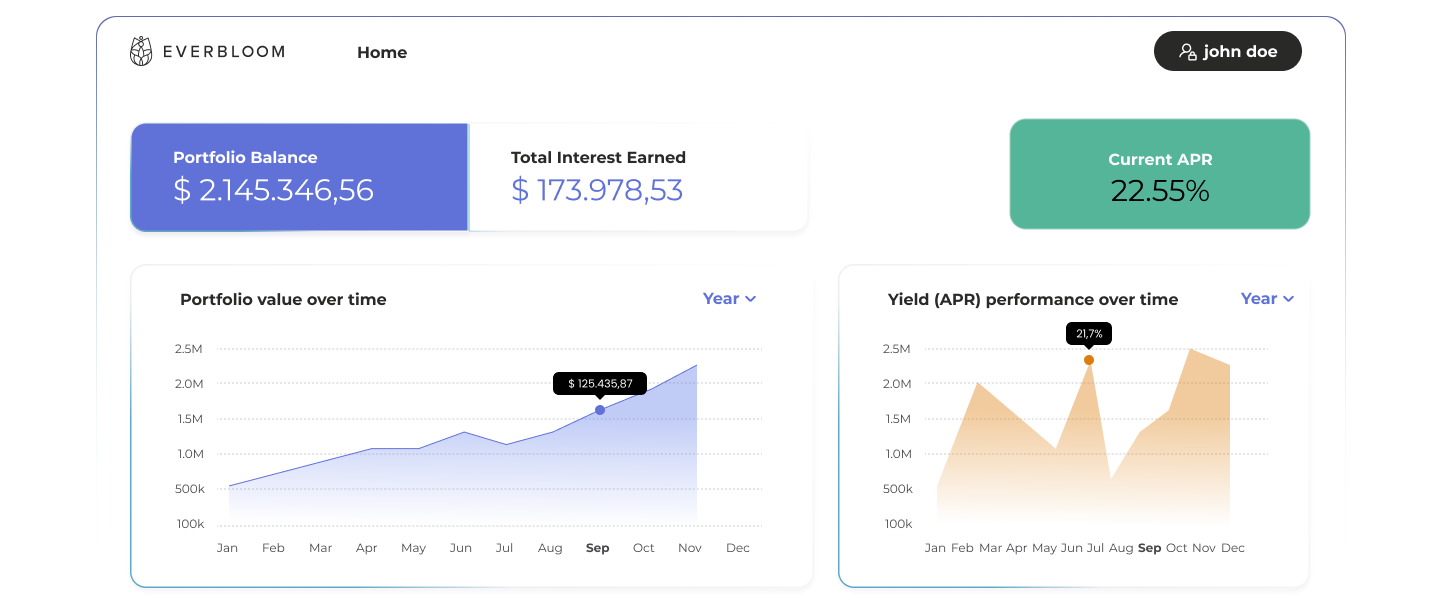

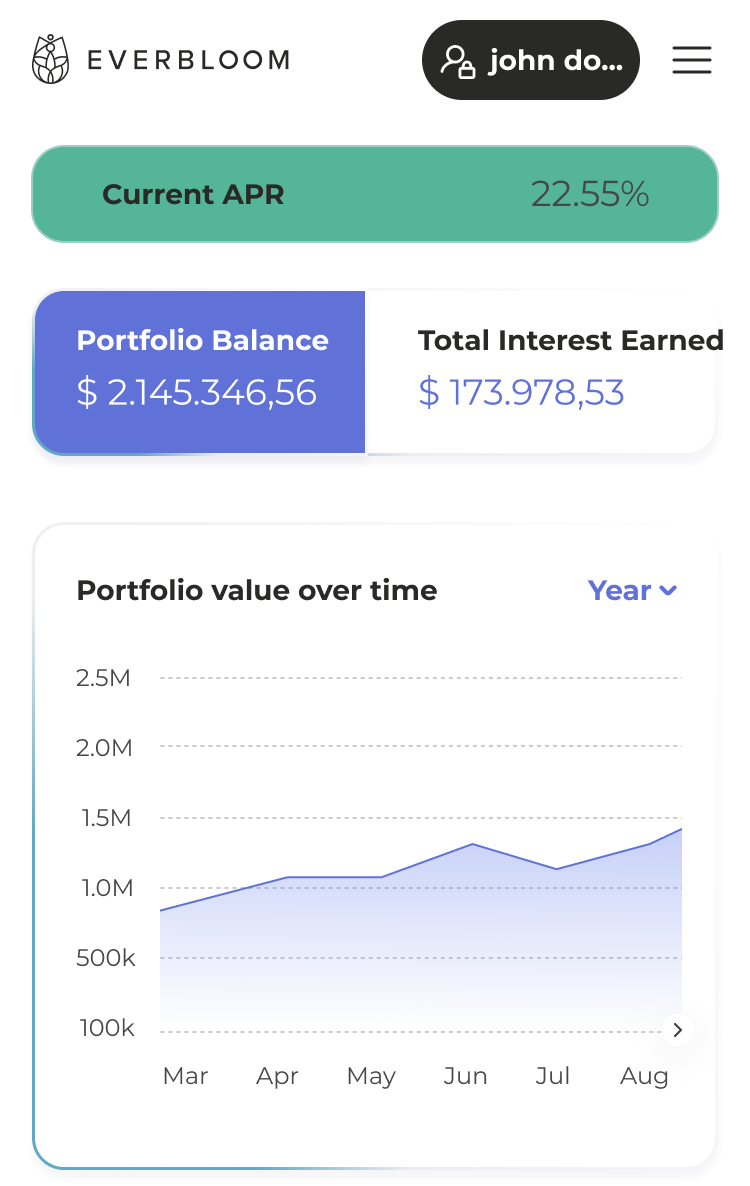

Effortless

Our platform offers an intuitive interface for our users with a comprehensive oversight over our strategies.

Consistent

Our strategies can adapt to different market conditions with ease, ensuring consistent yield optimization

Efficient

Maximize your returns through optimized strategies. Our algorithms continuously seek the best yield opportunities across DeFi and CeFi.

Market Neutral

We navigate market volatility with confidence. Our delta-neutral approach aims to generate consistent returns regardless of market direction.

Automated

Our advanced algorithms execute complex liquidity provisioning strategies that go beyond human capabilities.

Secure

Rest easy knowing your assets are protected. We employ institutional-grade security measures and rigorous risk management protocols.

Who we serve

High Networth Individuals

Everbloom offers high-net-worth individuals an ideal, low-risk avenue for diversification, balancing growth with stability to strengthen their portfolios.

Digital Asset Projects

Everbloom enables digital asset projects to grow their treasuries safely through market neutral, low-risk, yield-generating strategies. Everbloom’s flexibility enables projects to earn steady returns while keeping funds accessible for future growth and operational needs.

Funds

Everbloom provides Funds with a market neutral solution for generating yield on idle cash positions, meeting the need for security, liquidity, and efficient capital allocation.